Page:United States Statutes at Large Volume 98 Part 3.djvu/814 - Wikisource, the free online library

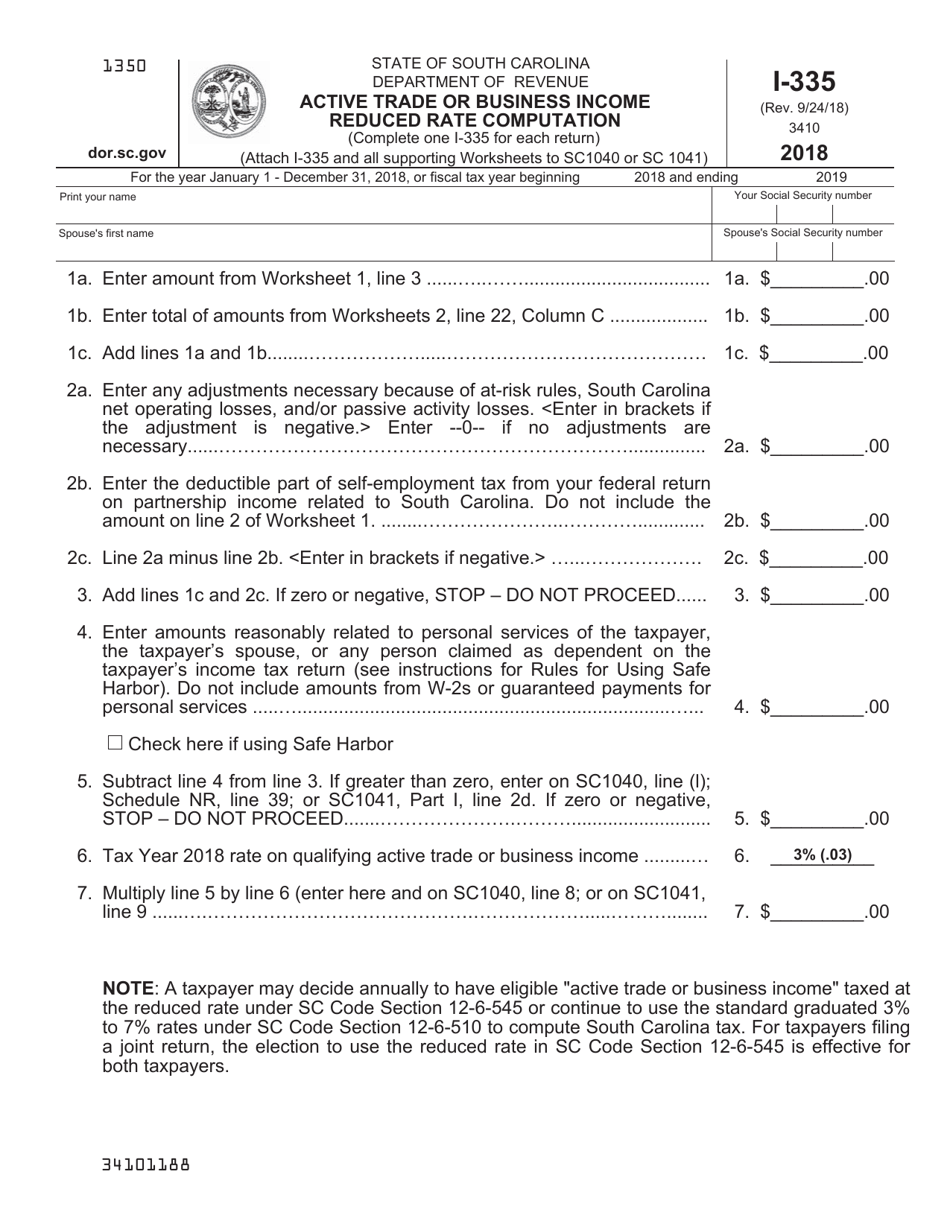

Form I335 - 2018 - Fill Out, Sign Online and Download Printable PDF, South Carolina | Templateroller

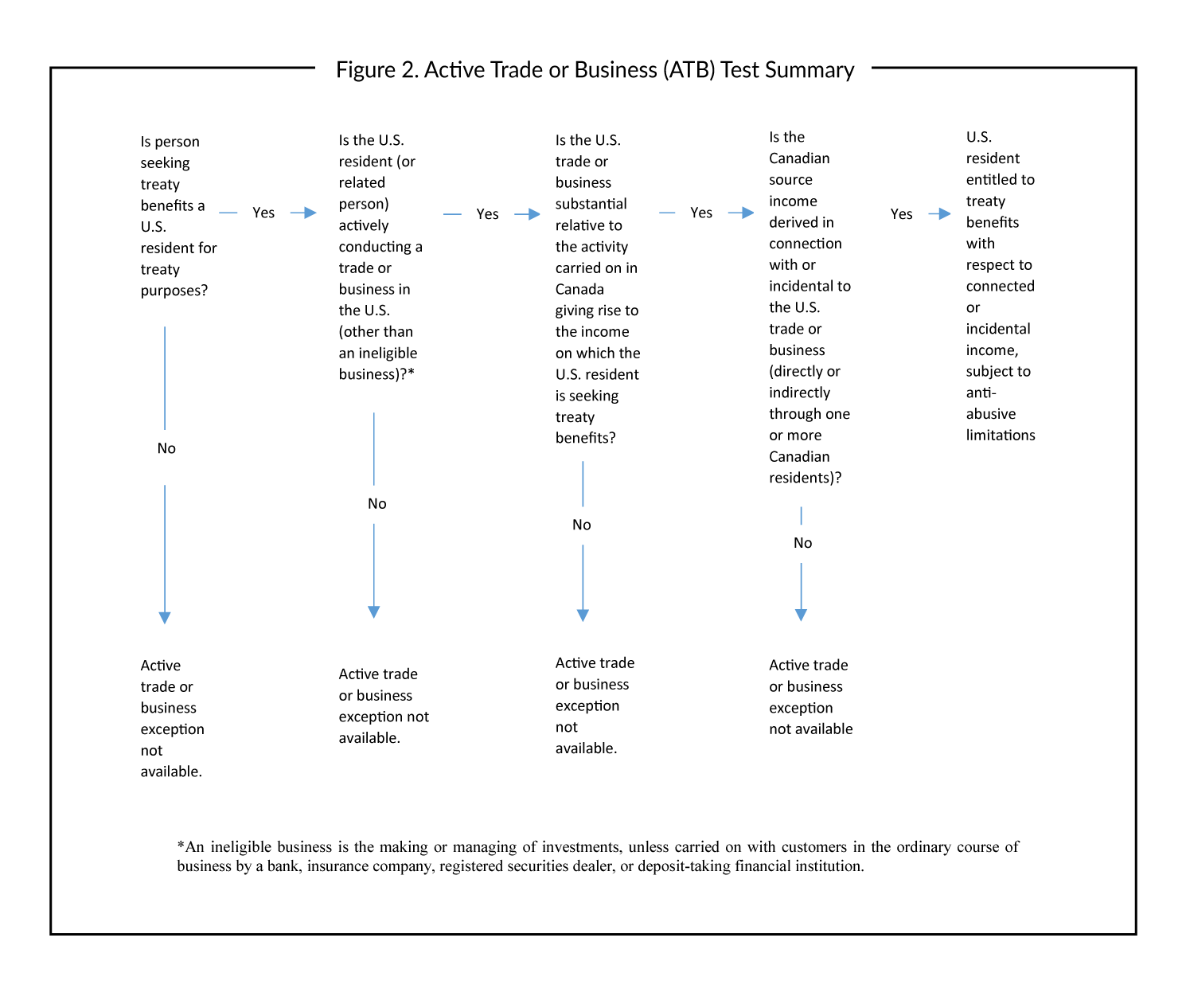

PPT - Accessing Income Tax Treaties Through Competent Authority – A Ray of Hope When All Else Fails PowerPoint Presentation - ID:143702

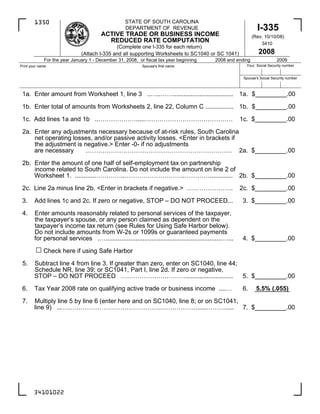

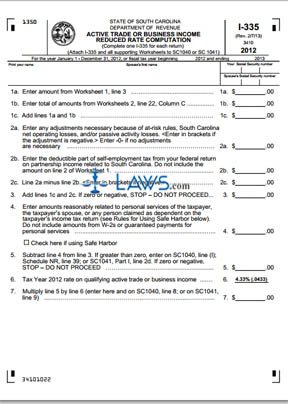

ACTIVE TRADE OR BUSINESS INCOME REDUCED RATE COMPUTATION 1a. 1b. 1c. 2a. 2b. 2c. 3. 4. 5. 6. 7. 1a. $______.00 1b. $______

FREE Form I-335 Active Trade or Business Income Reduced Rate Computation - FREE Legal Forms - LAWS.com

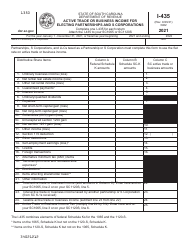

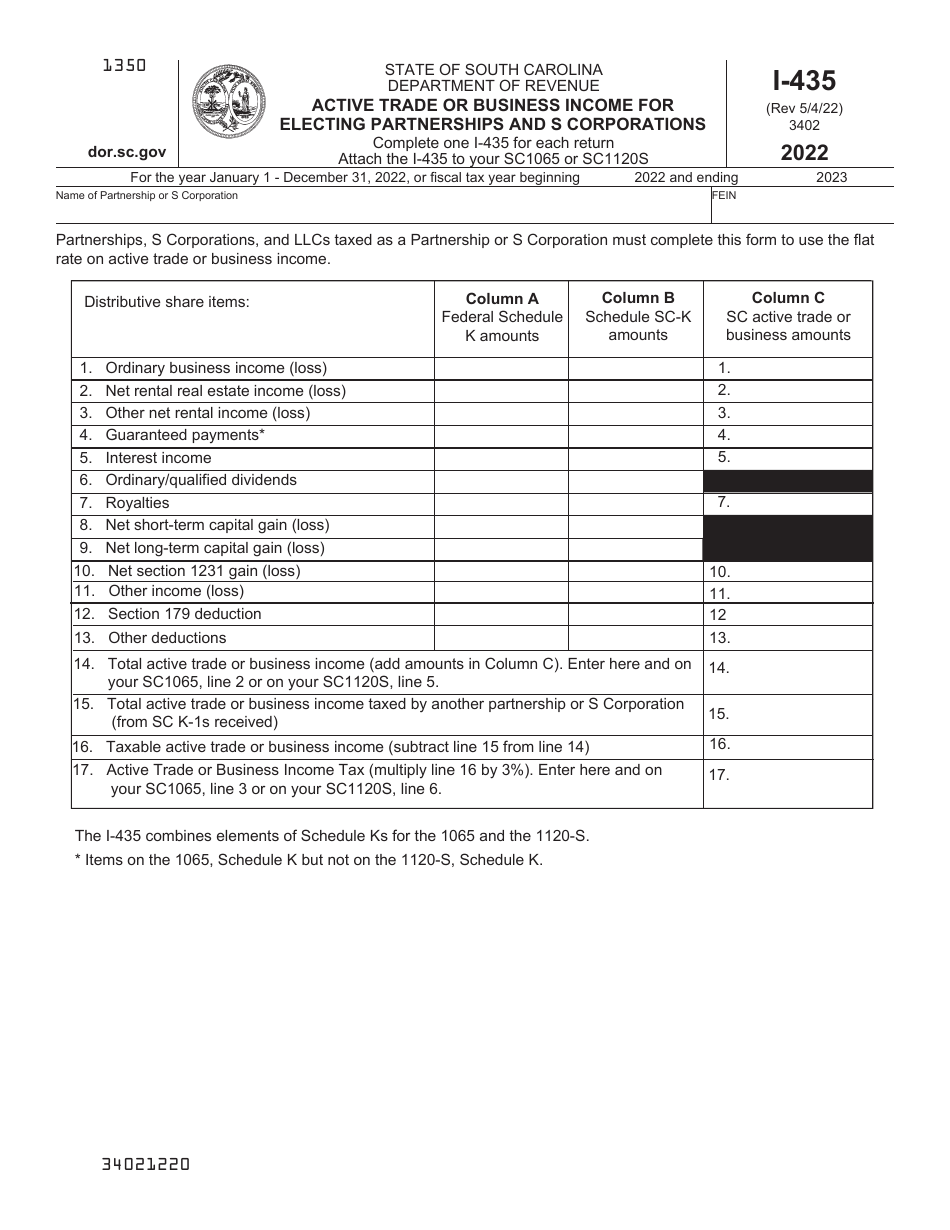

Form I-435 Download Printable PDF or Fill Online Active Trade or Business Income for Electing Partnerships and S Corporations - 2022, South Carolina | Templateroller

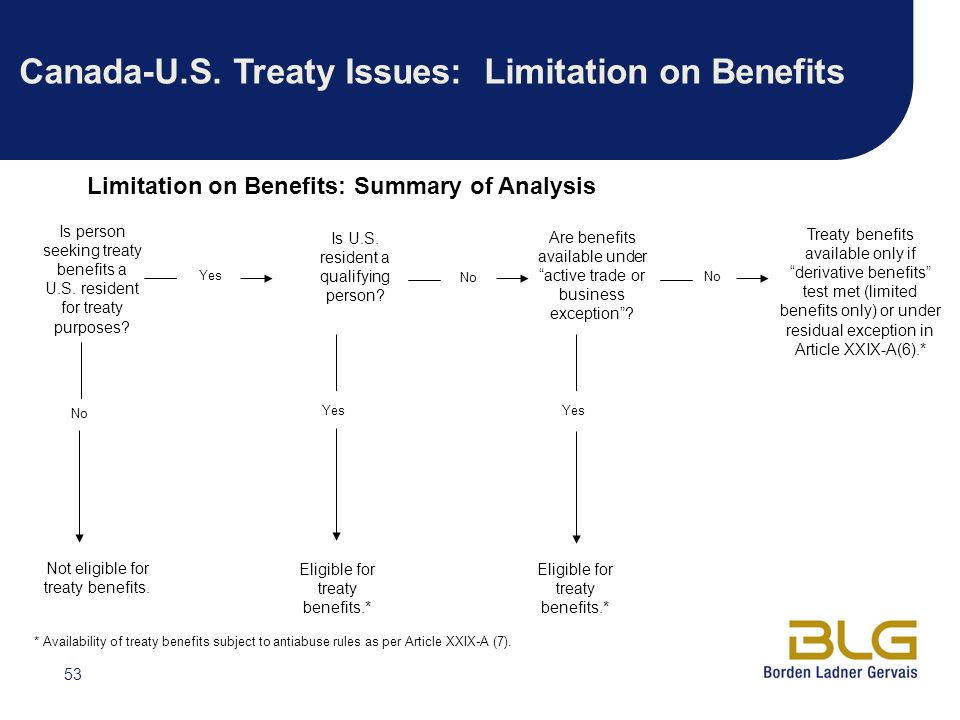

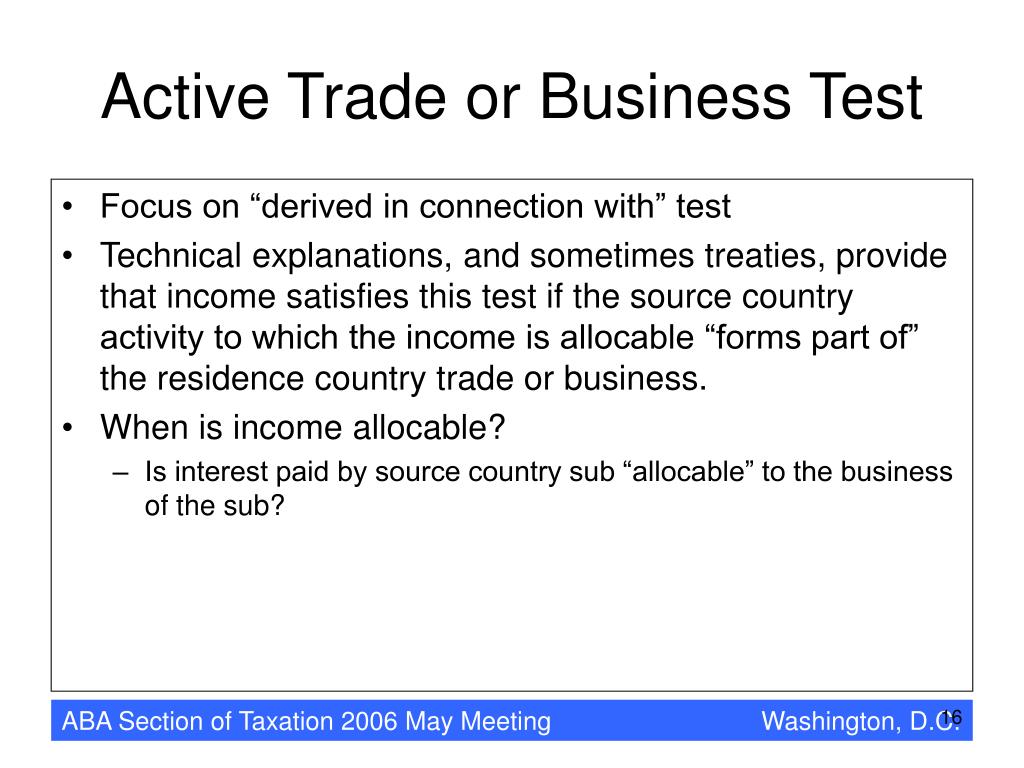

Tax Treaties and Anti-Treaty Shopping Initiatives Edward Tanenbaum, Alston & Bird LLP – Panel Chair American Bar Association Business Law Section Peter. - ppt download

Form I-435 Download Printable PDF or Fill Online Active Trade or Business Income for Electing Partnerships and S Corporations - 2022, South Carolina | Templateroller

I've entered K-1 income for SC in the SC interview form, but it does not recognize that I have any SC income for active trade or business income. What am i missing?

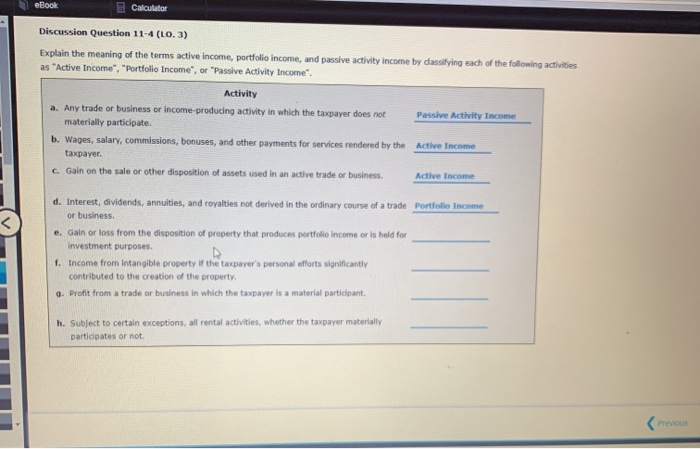

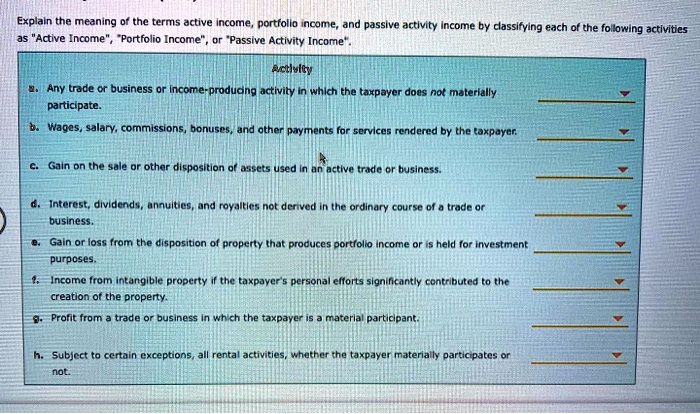

SOLVED: Explain the meaning of the terms active income, portfolio income, and passive activity income by classifying each of the following activities as Active Income, Portfolio Income, or Passive Activity Income: a.